Was ist die beste Tageszeit, um Forex zu handeln

Die Daten werden von unseren Mitarbeitern und Systemen regelmäßig aktualisiert.

Zuletzt aktualisiert: 13 Sep 2021

Wir erhalten Provisionen von einigen Affiliate-Partnern, ohne dass für die Nutzer zusätzliche Kosten entstehen (die Partner sind auf unserer Seite "Über uns“ im Abschnitt "Partner“ aufgeführt). Trotz dieser Partnerschaften bleiben unsere Inhalte unvoreingenommen und unabhängig. Wir erzielen Einnahmen durch Bannerwerbung und Partnerschaften, die keinen Einfluss auf unsere unbefangenen Bewertungen oder die Integrität unserer Inhalte haben. Unsere Redaktions- und Marketingteams arbeiten unabhängig und gewährleisten die Genauigkeit und Objektivität unserer Finanzinformationen.

Read more about us ⇾

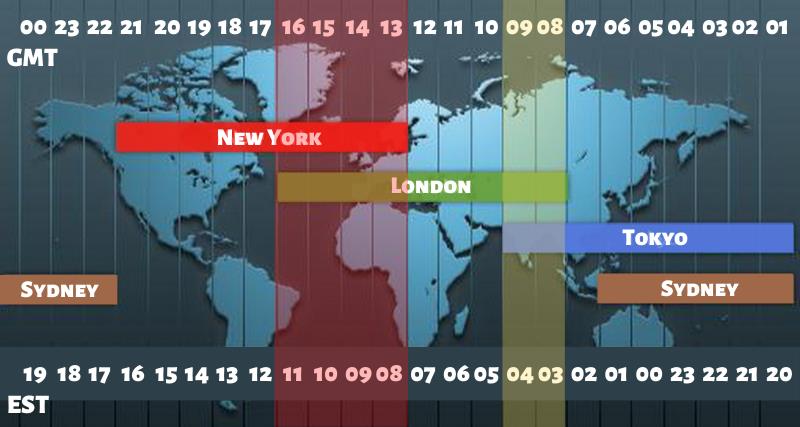

Der weltweite 24-Stunden-Forex-Markt kann grob in vier Handelssitzungen unterteilt werden, die den Stunden entsprechen, zu denen große Finanzzentren Geschäfte abwickeln und über Wirtschaftsdaten berichten.

- Nordamerika - New York, USA

- Asia - Tokyo, Japan

- Asien-Pazifik - Sydney, Australien

- Europa - London, Großbritannien

In den Zeiten des höchsten Handelsvolumens schaffen schnell bewegte Preise eher Chancen, während die Spreads ebenfalls am niedrigsten sind.

Die aktivste Handelsperiode ist normalerweise die 4-stündige Überlappung von London und New York zwischen 8:00 und 12:00 Uhr New Yorker Zeit, die allgemein als die beste Zeit für den Devisenhandel angesehen wird. Sydney und Tokio überschneiden sich ebenfalls zwischen 24:00-6:00 GMT.